[ad_1]

The UK is going through a recession with inflation set to soar to its highest charge since 1982, the Financial institution of England has warned.

The Financial institution on Thursday raised rates of interest by 0.25 per cent to 1 per cent in a bid to mood the spiralling price of dwelling, and warned that the economic system was more likely to shrink within the ultimate quarter of the 12 months.

Though the central financial institution’s Financial Coverage Committee (MPC) has not formally predicted a recession, the transfer raised the probability of the economic system shrinking.

The next three charts clarify the UK’s looming financial tumult.

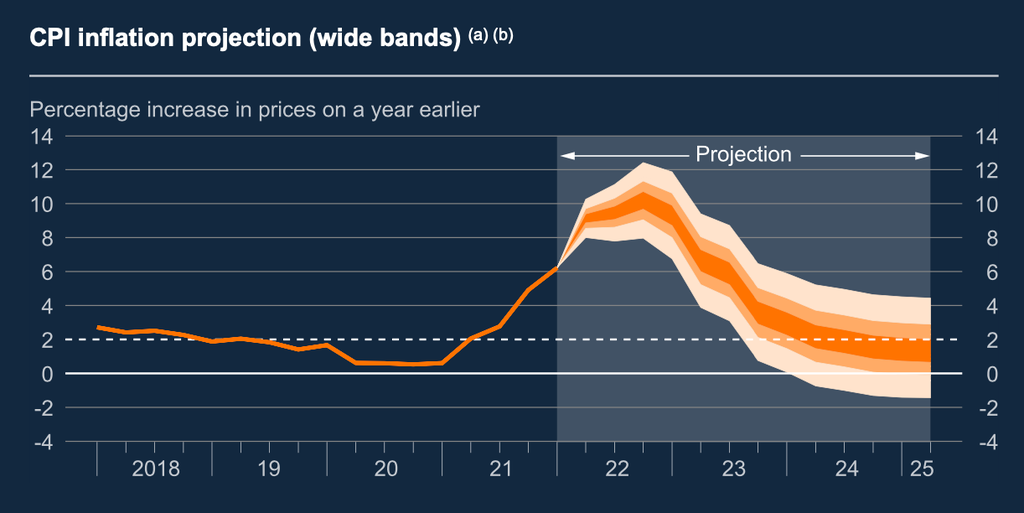

Inflation to soar

Inflation will rocket to greater than 10 per cent by the top of 2022 – the very best charge in 40 years – as thousands and thousands face an unprecedented spike in power payments and the second-biggest fall in dwelling requirements since information started.

(Financial institution of England)

An extra 40 per cent rise within the power worth cap is then anticipated in October, based on the Financial institution of England, to fulfill the surge in wholesale power prices pushed up by president Vladimir Putin’s battle in Ukraine.

The worth cap will see inflation peak at a later level within the UK in comparison with different nations, prompting warnings from the Financial institution of England that it might drop down extra progressively.

Common gasoline, electrical energy payments, meals costs and different important items are all anticipated to proceed to rise, the Financial institution’s MPC mentioned on Thursday.

GDP development to flatline

The economic system is anticipated to shrink in 2023 following a downgrade within the ultimate quarter of this 12 months. The Financial institution has anticipated development of 1.25 per cent subsequent 12 months, however now say that output will fall by 0.25 per cent as a substitute.

(Financial institution of England)

The chart predicts near-stagnant development for 3 years – with the Financial institution forecasting zero development in 2023, adopted by 0.2 per cent in 2024 and 0.7 per cent in 2025.

With the central financial institution predicting inflation to be up 10 per cent and GDP development down 1 per cent for the ultimate quarter of 2022, the projection appears to fulfill the remit of “stagflation”.

The figures will pile stress on chancellor Rishi Sunak to offer extra assist for struggling households.

Unemployment to surge

As inflation falls, unemployment will rise, the Financial institution expects.

(Financial institution of England)

Regardless of the UK’s labour market having recovered to pre-pandemic ranges in current months, pushed by the lifting of Covid restrictions and the resultant enchancment in financial outlook, unemployment is anticipated to surge because the looming financial catastrophe rears its head.

The Financial institution of England warns that unemployment might rise by 8 per cent by 2025 – the worst stage for the reason that banking disaster ended.

Its base prediction is for a enhance in unemployment from 3.9 per cent to five.5 per cent in three years’ time, which would depart round one other 450,000 individuals out of labor.

[ad_2]

Source link