[ad_1]

The next article is an opinion piece and isn’t supposed to be monetary recommendation.

“Ask your self: Is bitcoin going up greater than 3% yearly? Then it’s a mistake to not maximize your publicity on the present charge of inflation. Any mortgage you possibly can roll ahead for an affordable period of time is nice. A mortgage with a 10- to 15-year mortgage in opposition to your property is a no brainer.” — Michael Saylor

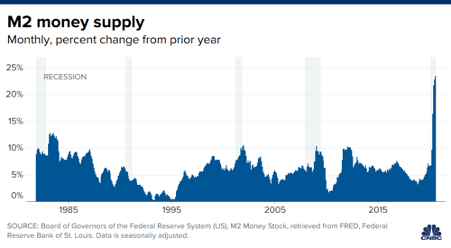

Bitcoin is one of the best insurance coverage in opposition to inflation. The continual issuance of cash by central banks has debased fiat currencies, destroying their buying energy. A couple of in 5 {dollars} was created in 2020 and 2021.

Knowledge from the Federal Reserve exhibits {that a} broad measure of the inventory of {dollars}, often called M2, rose from $15.4 trillion at first of 2020 to $21.18 trillion in December 2021. M2 is a measure of the cash provide that features money, checking and saving deposits and simply convertible close to cash like treasury payments and cash market funds. The rise of $5.78 trillion equates to 37.53% of the whole provide of {dollars}.

Bitcoin, which is restricted in provide, will increase in value as market contributors are in search of a great retailer of worth to guard their cash in opposition to inflation and authorities confiscation. This was illustrated by the latest spike within the ruble/bitcoin buying and selling pair with quantity growing as Russians seemed to bypass sanctions imposed by the worldwide group due to the Russian invasion of Ukraine on Thursday, February 24, 2022.

Bitcoin has outperformed most property within the legacy system over the previous decade and can probably proceed to take action. Bitcoin reveals the qualities of sound cash — shortage, sturdiness, divisibility, portability and fungibility — like no different financial asset in historical past. The supreme traits of bitcoin continually enhance the chance that it’s going to proceed to outcompete gold and fiat currencies by way of the Lindy impact, a principle that the longer some nonperishable factor survives, the extra possible it’s to outlive sooner or later. We could assume that bitcoin’s value will increase 60% to 70% per yr going ahead for the medium time period.

Each minute, hour, day and yr that bitcoin survives will increase its possibilities of persevering with into the longer term because it garners extra belief and survives extra shocks. Additionally it is value noting this goes hand-in-hand with the property of antifragility, the place one thing turns into extra strong or stronger with every assault or time the system is underneath some type of stress. As a result of inherent properties of bitcoin, any smart market participant will (and may) maximize their publicity to bitcoin over time.

The obvious factor to do is to purchase bitcoin. Nevertheless, this technique is restricted to the accessible liquidity. As well as, the prevailing liquidity may be tied up in tasks. For instance, an actual property investor must be liquid in fiat to have sufficient money readily available to fulfill monetary obligations, reminiscent of property upkeep or financial institution liabilities. Consequently, the duty is to extend the capital in the stores bitcoin with out placing your self in a susceptible place. When you have collected wealth within the present legacy system, you should use your property as collateral to incur fiat-denominated debt. Purchase bitcoin and repay the debt with money move out of your property or bitcoin’s value appreciation.

For some, probably many, it appears dangerous to tackle debt to purchase bitcoin when the other is true. Borrowing fiat-denominated debt to purchase bitcoin is among the biggest enterprise alternatives of our lives. Debt denominated in fiat that you simply tackle as we speak will lose worth sooner or later whereas the value of bitcoin rises. As well as, rates of interest are at the moment low.

Bitcoin’s attraction comes from the truth that its financial coverage is incorruptible and unalterable. There’ll by no means be greater than 21,000,000 bitcoin. Which means these folks that voluntarily select to tackle debt in an inflating forex in favor of a disinflationary and sound forex will have the ability to accumulate long-term oriented capital at a disproportionate charge to those that don’t.

USD/SAT Historic Efficiency. A sat (satoshi) is the smallest denomination of bitcoin, equal to 100 millionth of a bitcoin (Supply).

Michael Saylor, CEO of software program intelligence agency MicroStrategy, has brilliantly laid out a blueprint of methods for utilizing fiat debt to purchase bitcoin.

In August 2020, Saylor famously announced MicroStrategy’s first bitcoin buy, stating that the corporate had transformed $250 million from its money holdings to greater than 21,000 bitcoin. By late September the identical yr, Saylor transformed an additional $175 million dollars into bitcoin, successfully changing 100% of MicroStrategy’s money place into bitcoin.

MicroStrategy introduced the closing of its “bond providing” of senior secured notes due 2028 with the intention of utilizing the proceeds to purchase bitcoin on June 14, 2021. The mixture principal quantity of the notes offered within the providing was $500 million and the notes bear curiosity at an annual charge of 6.125%. The notes have been offered in a personal providing to certified institutional consumers.

The notes are totally and unconditionally assured on a senior secured foundation, collectively and severally, by MicroStrategy Providers Company. The notes and the associated ensures are secured, on a senior secured foundation with MicroStrategy’s present and future senior indebtedness, by safety pursuits on considerably all of MicroStrategy’s and the guarantors’ property. This consists of any bitcoin or different digital property acquired on or after the closing of the providing, however excluding MicroStrategy’s present bitcoin in addition to bitcoin and digital property acquired with the proceeds from present bitcoin.

In parallel, MicroStrategy introduced a $1 billion inventory providing. The corporate used the proceeds from the sale of its Class A typical inventory to accumulate much more bitcoin. In whole, MicroStrategy accomplished 17 bitcoin purchases. On the time of writing, the corporate holds 125,051 bitcoin for which it has paid a complete of $3.78 billion, with a median buy value per bitcoin of roughly $30,200. MicroStrategy’s present bitcoin is being held by a newly shaped subsidiary, MacroStrategy LLC.

Though Michael Saylor purchased bitcoin late, he understands the worth of bitcoin very nicely. It’s digital gold for the digital age. It’s a objective constructed cash for the digital age — permissionless, open-source, sound and world. Bitcoin is straightforward to purchase, retailer and promote. Excessive in liquidity and tradable 24/7.

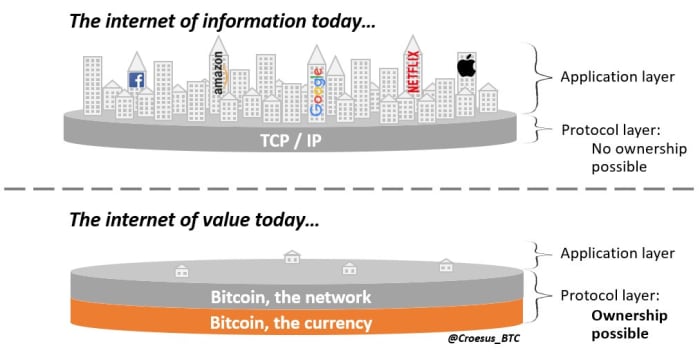

Bitcoin has a singular worth proposition. Bitcoin as a protocol for exchanging worth lets you instantly personal a part of it. The Bitcoin community is a transaction processing system. From transaction processing comes the flexibility to alternate cash, which is bitcoin the asset, the forex that represents the worth of the underlying system. It’s each a cost community and an asset, backed by essentially the most resilient pc community on this planet. In case you might personal a part of the web, would you say no?

(Source)

The volatility in bitcoin is pure to commodities. We observe comparable value patterns in gold and oil. Bitcoin’s volatility is extra excessive as it’s the first globally traded asset, however as its market cap will increase, its volatility decreases.

The volatility is powerful day-to-day, however over 5 years, nobody who has held for the complete interval has ever misplaced cash, even the folks that purchased at market tops. Anyway, the volatility permits for excellent entry factors. Extra vital is the liquidity and accessibility of bitcoin. Saylor has stated, “Attempt to promote $100 million value of gold on a Saturday in your iPhone … I wager that received’t work.”

As well as, the volatility is to the upside. The volatility of a deflationary asset is preferable to the decrease volatility of an inflationary asset.

Leveraging Your Belongings

In case you perceive the worth proposition of bitcoin, you might do what Saylor did. Take a look at your property within the legacy system and leverage the long-term worth of these property into bitcoin. Do you personal a enterprise? You may borrow cash with the corporate and pay the curiosity with earnings from the corporate. Do you personal actual property? Use the actual property as collateral to borrow cash and pay again the mortgage with the rental revenue. It is best to talk on to a Bitcoin-friendly financial institution as a result of you do not have to elucidate bitcoin’s worth proposition. Nevertheless, a financial institution doesn’t essentially wish to know the aim of a mortgage if the collateral that secures it has a great money move, for instance, a property with good rental revenue. I nonetheless suppose it is vital to be clear when the financial institution asks for it. This ought to be assessed on a case-by-case foundation.

Since bitcoin may be very risky, you have to be cautious. Value declines of 40–60% happen recurrently in bitcoin. Do not make your self susceptible to cost fluctuations. You have to cope with volatility, so preserve the loan-to-value (LTV) low. I recommend a loan-to-value ratio of 10–25%. As well as, a mortgage ought to solely be taken out if bitcoin experiences a major drop in value, as the danger of an extra drop in bitcoin’s value is considerably decreased. A mortgage ought to have a minimal time period of a minimum of 5 years, ideally 10 or 15 as bitcoin bear markets can traditionally last as long as three years. This technique applies to each people and firms.

I’ll present how efficient this technique is utilizing the instance of a property owned by a medium-sized actual property improvement firm:

Firm A builds and owns a 68-unit condominium constructing. The property brings in annual rental revenue of $750,000. A financial institution will typically worth the property based mostly on 20 occasions the annual rental revenue multiplier, i.e., $15,000,000. Usually, the development of such a property was financed by a financial institution. Firm A might apply for an extra $2,000,000 mortgage with a 10-year time period and 5% curiosity, i.e., $100,000, with the property as collateral from the financial institution that financed the development of the property. The mortgage would correspond to round 13.3% of the collateral.

Firm A will use the rental revenue from the property to service the annual curiosity cost.

This leaves greater than sufficient rental revenue to service present obligations, together with the curiosity cost on the preliminary building mortgage and the supply for any prices that will come up, with out creating pointless extra dangers.

Rental revenue ($750,000) minus 5% annual curiosity cost ($100,000) equals $650,000.

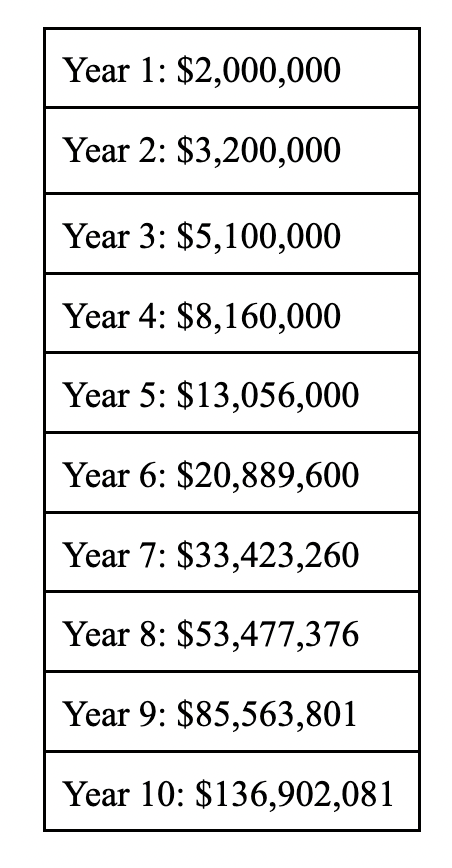

Assuming that bitcoin grows at a 60% annual rate-of-return, after 10 years, the bitcoin acquired with the mortgage may have the next worth:

The potential worth of a $2 million greenback bitcoin purchase if the value appreciates at a 60% annual rate-of-return.

Nevertheless, this could imply that the worth of bitcoin, at the moment about $42,000, will rise to over $2,600,000 in 10 years. For me as a Bitcoiner, this value is probably going, particularly contemplating that roughly 10 years in the past, the closing value for bitcoin on December 31, 2012, was $13.45. However I do not suppose bitcoin will develop as rapidly as a result of it is merely a matter of larger sums now to see such development, that will require plenty of nation-states to undertake bitcoin as a reserve forex, which is able to probably take extra time to play out.

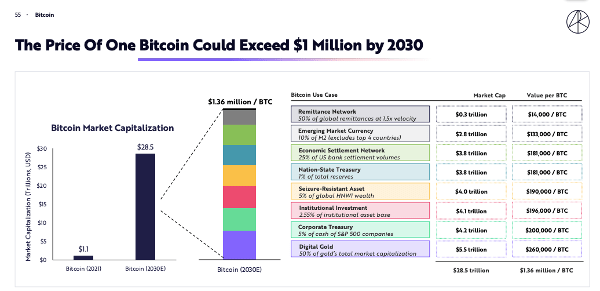

We should always, due to this fact, cap the bitcoin value at $1,000,000 by 2030. These assumptions are based mostly on a bitcoin value prediction by ARK Make investments.

Assuming a bitcoin value of $38,000 from the time this text was written, Firm A can purchase 52.63157894 bitcoin with $2,000,000 ($2,000,000 divided by $38,000). Assuming bitcoin grows to a value of $1,000,000 by and after 2030, the bitcoin bought with the mortgage shall be value round $52,631,579 after 10 years.

Nobody can predict the longer term, however we will safely assume that the adoption of bitcoin has reached the purpose of no return. This has been confirmed by the acceptance of bitcoin as authorized tender in El Salvador and its inclusion on plenty of stability sheets by Nasdaq-listed corporations reminiscent of Tesla and MicroStrategy.

Its use case as a digital retailer of worth implies that steady adoption is accompanied by a steady enhance in value. There’s merely no higher know-how than Bitcoin that fulfills the function of a digital retailer of worth. Simply as humanity by no means went again to horses after the event of vehicles, we is not going to cease utilizing bitcoin and return to an inferior forex just like the U.S. greenback, gold or U.S. Treasuries as a retailer of worth.

We will, due to this fact, conclude that Firm A, with a low loan-to-value of round 13.3% and an curiosity burden that doesn’t contain pointless danger, could make an above-average funding by taking over the fiat-denominated debt and shopping for bitcoin.

In a future article, I’ll present how Firm A could make use of the bitcoin they maintain on account of buying the bitcoin as illustrated above.

For extra sources go to:

Pomp Podcast #385: “Michael Saylor On Shopping for Bitcoin With His Stability Sheet”

Bitcoin Technique with Michael Saylor, CEO of MicroStrategy

(Source)

It is a visitor publish by Leon A. Wankum. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.

[ad_2]

Source link